For the first time in any of our memories, valuers cannot go out to look at any sort of residential or commercial property, including social housing. All inspections stopped in mid-March. Since then, we have been working against the most turbulent economic and financial backdrop imaginable – the stock market has fallen, consumer and business confidence has plunged by record amounts, interest rates have been cut to almost zero, swathes of the economy have ceased to function, including the housing market, and recently, oil prices even turned negative, all accompanied by extraordinary interventions in terms of government policy. No one has any clear idea of how long this will last, how we will chart our way back to normal or what the long-term economic and social consequences might be.

The key issues are volatility and uncertainty. How do we deal with these when valuing social housing, as an asset with stable, long-term cash flows? Both the income and expenditure sides of our valuations are affected by the factors above, and by the housing market.

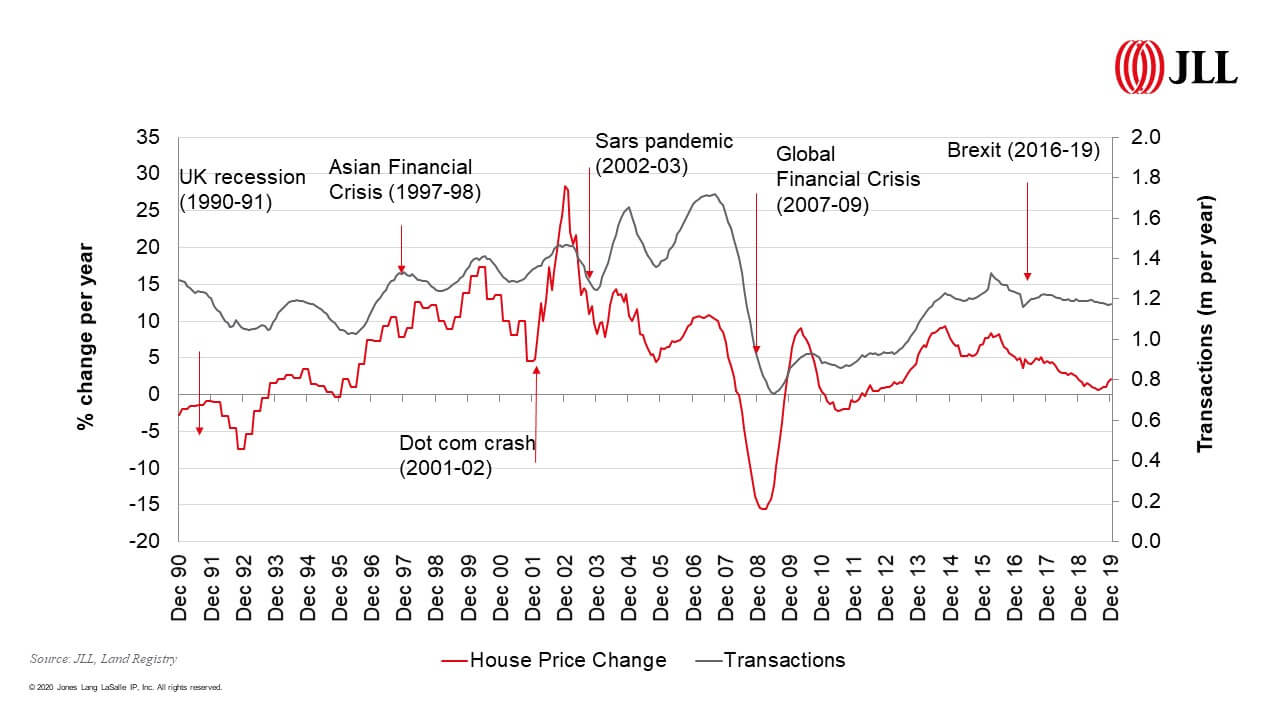

There is a close correlation over the last 30 years between the level of housing transactions and house prices (see graph below). When the number of transactions falls, so house prices fall; and, when something triggers a fall in house prices, transactions rapidly turn down in response. Whilst there is little evidence so far that house prices are falling in a market that has almost (but not completely) ceased to transact, it seems likely that house prices will fall during the remainder of this year.

Moreover, early predictions of a steep, V-shape fall and recovery are starting to be adjusted to ones where the recovery side of the V slopes more gently upwards and extends for longer – more of a tick. But the housing market and the economy are closely linked and government’s decisions on easing the lockdown will have a material influence on how this plays out. Government policy to incentivise both housing demand and supply in the second half of the year will be critical

Despite all this, EUV-SH values of social housing are holding up well and I expect them to continue to do so. There are downward pressures. We are seeing rent arrears going up as a result of tenants experiencing financial hardship; voids are increasing slightly; and there are heightened risks to the element of rent not supported by benefits. But, on the plus side, RPs are doing a lot to mitigate these impacts on their income. Management costs are down, simply as a result of being able to do less; non-urgent works that are not health and safety related are being delayed, including cyclical maintenance, external decorations and planned works involving delaying both revenue and capital expenditure into next year – anecdotally, down by 50% or more this year. There is also unprecedented government support for incomes through its furlough scheme, and recent LHA reforms are helping to underpin rental income.

This leads us to the view that values are holding up and will continue to do so. We can also take confidence from several stock rationalisation transactions which have completed since the crisis began, and from the successful bond issues in April by Optivo, Sanctuary and Guinness, all of which have been oversubscribed and keenly priced. Investors want social housing for its traditional characteristics and strengths. There should not be any great causes for concern for RPs (or their auditors) around valuations for the end of financial years.

Valuations on the basis of MV-T do, however, present some different challenges. MV-T valuations rest on two principal assumptions: first, that the hypothetical purchaser would increase social rents to market rents as rapidly as possible; and, secondly, that voids arising in the normal course of managing the stock would be sold on the open market. Those sales are unlikely to be there in the short term and, as stated above, house prices are likely to fall this year, with no growth in market rents as the economy and labour market struggle. The income side will therefore carry more risk but, as for EUV-SH, some capital expenditure by landlords will be deferred and the LHA reforms accompanied by the furlough scheme are helpful.

On balance, we expect MV-T valuations reported during the crisis period may fall by up to 10%, depending on local circumstances. In areas of low house prices, the impact will be less and could be zero; conversely, in areas where high house prices make the valuation more sensitive, the impact will be greater.

Despite the restrictions during lockdown, valuers are continuing to value. This includes both revaluations and new charging of properties for loan security. The lenders deserve great credit for adapting quickly, recognising the restrictions under which we are working, and being flexible in their normal instructions. In some cases, we will go back and do inspections when restrictions are lifted; in others, valuations are being accepted on the wealth of digital information which is available without inspections, or the revaluation cycle is being delayed for a few months.

Under RICS rules in the Red Book, there is provision both for valuers to deploy a material uncertainty clause (MUC) and to report on the basis of restricted information. An MUC should currently appear in any valuation report, including for social housing, but this should be seen as a necessary disclosure to anyone reading or relying upon the report, given the difficult trading conditions, and not in any sense a disclaimer. Valuations are still being reported with the normal level of formal reliance and lenders should not have any qualms on this score.

In summary, from a valuer’s perspective, the social housing sector remains in remarkably robust financial health. If we are seeing small increases in rent arrears and voids, compare that with the commercial market where many landlords are collecting barely half what they are owed in rent and, in many cases, much less. The lenders are all being supportive, and both RPs and institutional investors have demonstrated their clear appetite for putting more money into the sector. As valuers, we can take great comfort from this transactional activity and in continuing to report values for both loan security and balance sheet purposes, with reliance, in the confidence that they are robust.

Richard Petty

Head of UK Living Advisory

If you’d like to read more on our COVID-19 insights click here