With the October Budget behind us, the outlook for both prices and rents remains positive. The government is forging ahead with its plan to deliver more homes, but it will take some time before we see any real impact on overall supply. Increased government borrowing means the latest inflation forecasts from the Office for Budget Responsibility have come in higher than expected, which could throw some cold water on more bullish forecasts for mortgage rates. But the direction of travel appears to be the same, even if it may take a little longer to get there.

Lack of supply and more competitive mortgage rates are expected to underpin growth in prices over the next five years. Rental growth is expected to exceed inflation and wages over the five-year forecast period, but an increase in activity in the sales market means rental growth is expected to lag price growth, with rents forecast to be 17% higher by the end of 2029.

2024 outlook

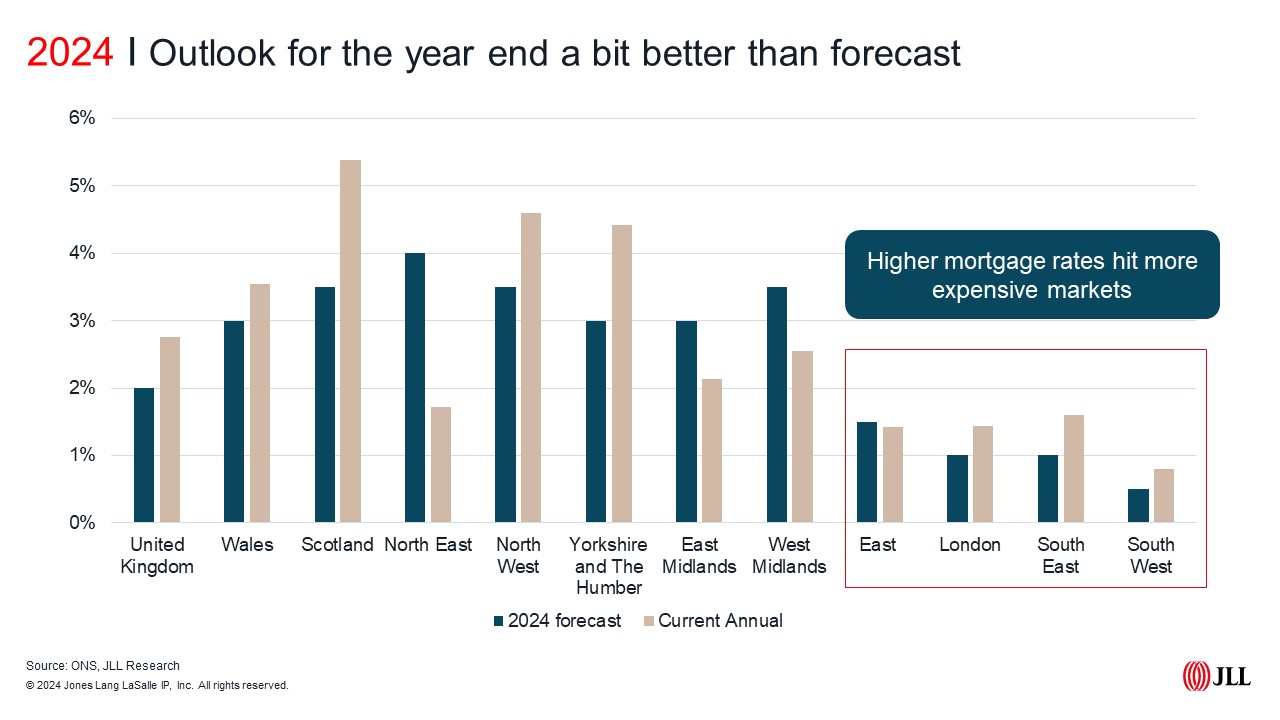

Back in May we forecast house prices nationally would rise by 2% in 2024. This was underpinned by a continued resilience and lack of distress in the sales market, with prices holding firm despite the challenge of higher rates and uncertainties in the run up to the election (which at that point we were thinking would take place in the autumn). An early election was seen as a positive for the market, but Budget jitters meant much of that hoped for momentum was lost (or at least delayed).

Looking at the latest government figures (year to August 2024) shows prices have risen 2.8% annually, with more recent Nationwide figures for the year to October at 2.4%. There are obviously a few months to go but we expect year end growth to come in marginally above our 2% forecast. Scotland and the north of England are expected to see higher growth. Higher mortgage rates remained most challenging for more expensive markets in London and southern England, with growth in these regions, as forecast, lower than other areas of the UK this year.

We forecast UK rents would end 2024 4.5% higher annually. The ONS Private Rents Index, which we benchmark against, is still showing growth of 8.4% in the year to August, but new lets data from Homelet data shows average rents were 4.3% higher in September 2024 than they were a year earlier. We expect ONS figures could end the year higher than our 4.5% forecast, but the significant imbalance between tenant demand and supply has levelled off in recent months so we expect some further heat will come out of the rental market as we move into 2025.

Lessons from the (recent) past

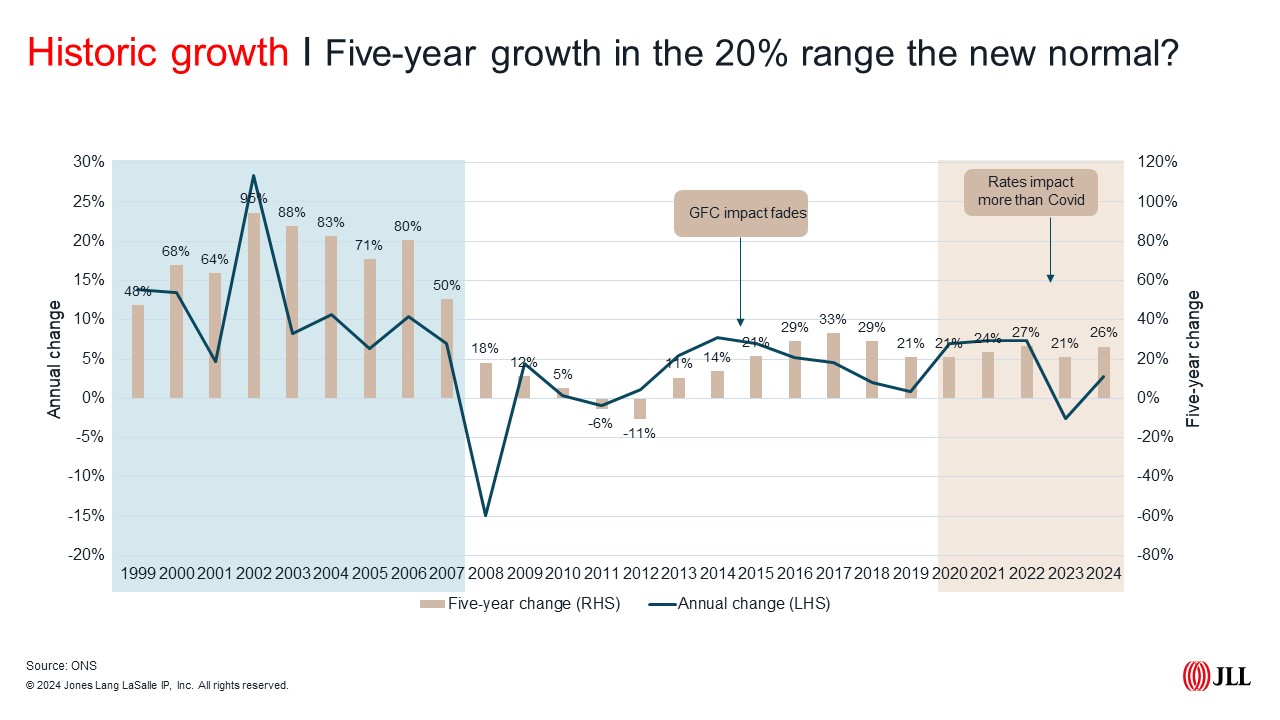

Looking back over the last 25 years, price growth (taken here in five-year chunks to mirror our five-year outlook) shows three distinct periods for growth. Before the Global Financial Crisis five-year growth of 60% or more was the norm. But the period of re-correction that followed saw much of this froth removed from the market as five-year growth fell back to single digits or low teens to compensate for the significant tightening of the debt markets.

But for the last decade, despite significant variation in mortgage rates and a global pandemic, house prices rises over a five-year term have remained remarkably consistent. Peaking in 2017 at 33% but otherwise ranging from 21% to 27%.

UK Economy

| 2025 | 2026 | 2027 | 2028 | 2029 | Change 2025-29 | |

|---|---|---|---|---|---|---|

| CPI (OBR) | 2.6 | 2.3 | 2.1 | 2.1 | 2.0 | 11.6 |

| Wages (OE) | 2.7 | 2.4 | 2.5 | 2.8 | 2.9 | 14.0 |

| UK GDP (OBR) | 2 | 1.8 | 1.5 | 1.5 | 1.6 | 8.7 |

Source: JLL Research using Office of Budget Responsibility, Oxford Economics

The outlook for economic growth remains muted, with inflation expected to sit a little higher than the Bank of England’s 2% target until 2029. But the Bank of England rate cutting cycle is expected to continue and assuming swap rates settle post Budget and the US election we’ll likely see mortgage rates fall back too - if not quite as quickly as we had hoped.

Consensus forecasts suggest rate cuts will run through until the end of 2026, with mortgage rates expected to become more competitive over this period. Following a similar trend to 2024 we anticipate lower value markets will benefit first. Activity will be driven by first time buyers, with home movers following once rates become more attractive. Higher value markets in London and the south are expected to see stronger growth in the second half of our five-year forecast period.

Market activity

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | |

|---|---|---|---|---|---|---|

| Housing Starts | 135,000 | 157,000 | 179,000 | 199,000 | 224,000 | 244,000 |

| Transactions | 1.0m | 1.2m | 1.3m | 1.3m | 1.3m | 1.4m |

Source: JLL Research, Experian

Committing to build 1.5 million homes over the course of this parliament, the government has set itself an ambitious target. But ramping up delivery without any demand side stimulus will be a real challenge. Current supply side plans have started

to put the building blocks in place to ramp up delivery but increasing delivery in a meaningful way with current planning, labour force, and supply chain constraints won’t be a quick fix. JLL forecast new housing starts across the UK will total

1 million homes between 2025 and 2029. Conversions of existing stock (currently accounting for around one in ten net additions) are expected to rise too, so we’ve allowed (possibly sightly ambitiously) for 200,000 in the next five years

taking us to a forecast of 1.2 million homes.

Sales price forecasts

| Sales price growth (% pa) | 2025 | 2026 | 2027 | 2028 | 2029 | Change 2025-29 | Average pa 2025-29 |

|---|---|---|---|---|---|---|---|

| UK | 3.5 | 4.0 | 4.5 | 3.5 | 3.0 | 19.9 | 3.7 |

| Greater London | 2.5 | 3.5 | 5.0 | 5.0 | 4.0 | 21.6 | 4.0 |

Source: JLL Research

A new government with ambitious plans for housebuilding and more comfortable with a higher tax environment, particularly for wealthier households, could mean future growth prospects differ from the recent past. But neither of the these seem a sufficient departure from the current trend to meaningfully change the path of growth over the coming five-year period (2025-2029).

We do expect higher rates (even if they fall back from current levels) will limit growth prospects, meaning our 2025-2029 forecasts sit at the lower end of the recent five year averages.

We expect growth of 19.9% nationally 2025-2029. London house prices are expected to increase by 21.6% over the same period, underpinned by a lack of new homes reaching the market for sale. We expect lower value markets to see stronger growth towards the

beginning of our five-year forecast period, with more expensive markets outperforming once the rate cutting cycle continues into 2026 and 2027.

Rental forecasts

| Rental growth (% pa) | 2025 | 2026 | 2027 | 2028 | 2029 | Change 2025-29 | Average pa 2025-29 |

|---|---|---|---|---|---|---|---|

| UK | 3.0 | 2.5 | 3.0 | 3.5 | 4.0 | 17.1 | 3.2 |

| Greater London | 2.5 | 3.0 | 3.5 | 4.0 | 4.5 | 18.8 | 3.5 |

| UK BTR | 3.5 | 3.5 | 3.5 | 4.0 | 4.5 | 20.5 | 3.8 |

Source: JLL Research

In the five years to September 2024 rents rose nationally by 27%. But the rapid rise in rents in the last three years isn’t reflective of the long-term trend. Five-year growth figures in early 2020 sat at around 12%, when rents broadly tracked wage growth.

The supply demand imbalance which has in part driven rent rises (wage growth and inflation also contributed) is now becoming more balanced, but a lack of new stock entering the market means we anticipate rental growth will exceed wage growth and inflation over the next five years.

The October Budget did little to change our view. Capital Gains Tax for residential property remained the same, meaning exit costs didn’t rise, but entry costs did. Landlords looking to purchase homes now having to pay an additional 2% stamp duty over the previous already elevated bill. We expect this will mean more traditional buy-to-let landlords will leave the market than enter over the next five years.

But activity in the sales market is expected to increase too, likely meaning an increase in tenants moving across into owner occupation, alleviating some demand side pressures in the short term.

JLL forecast UK rents will rise 17% over the next five years, with rental growth in the London expected to total 18% over the same period.

What to watch

- EPC C by 2030 – Around half of all privately rented homes nationally are EPC D or below. As we move closer to the 2030 deadline, we expect some landlords will offload less efficient stock or remove properties from the

market to retrofit to meet the new standard. Expect rents to rise in the run up as stock levels fall. For sales, landlords selling properties could bring more lower value homes to the market impacting average prices.

- Renters Right Bill – Current proposals include the provision for tenants to challenge market busting rental increases. Our forecast for lower annual increases will help cushion the impact here but may limit the potential for

growth in some markets, particularly if the courts are overwhelmed with applicants. Landlords concerned around the impact of the bill could also chose to exit the market, particularly as the sales market improves.

- Buyer incentives – With the stamp duty threshold returning to its previous £300,000 level for first time buyers next spring there was surprisingly little in the budget to incentivise buyers. However, there was reference

to Phase 2 of the Spending Review in Q2 2025, so we could see further incentives or concessions introduced then.

- Rates – A more rapid fall in mortgage rates could mean higher value markets see stronger growth earlier.

- Housebuilding – The government has ambitious plans for new homes. We do expect activity to increase but still assume starts will lag the 1.5 million target. Our current forecast accounts for stock scarcity in the new homes

market towards the start of the five-year period with new development activity not expected to be sufficiently high to have any negative impact on prices.

- International buyers and prime London – Changes to non-dom rules and increases in SDLT on additional properties mean higher costs for overseas buyers. But a lack of stock, particularly of new homes, means those who are in the market may find choice scarce and competition for the best stock remains strong.