The Older People’s Housing Taskforce Report published this week by the MHCLG flagged stamp duty as holding back activity in the later living market (it mentions it 17 times in the exec summary alone). We need between 30,000 and 50,000 new later living homes per annum but only currently build around 7,000. The report suggests introducing stamp duty incentives or equalising first-time buyer and ‘last-time buyer’ rates for those looking to downsize could increase activity and allow older households to move to more suitable properties. Read more here.

We’re unlikely to hear more on incentives until the Spending Review this coming spring, but until then we thought it was worth looking at rates, who pays and where revenues are coming from.

Broader shoulders in higher value markets

Property transaction tax (the majority of which is residential SDLT) is expected to bring in £12.8 billion in the year to March 2024, rising to £25 billion per annum by 2030 according to the OBR. Property transaction tax receipts are forecast to be around 40% higher than the much-discussed inheritance tax take over the next five years.

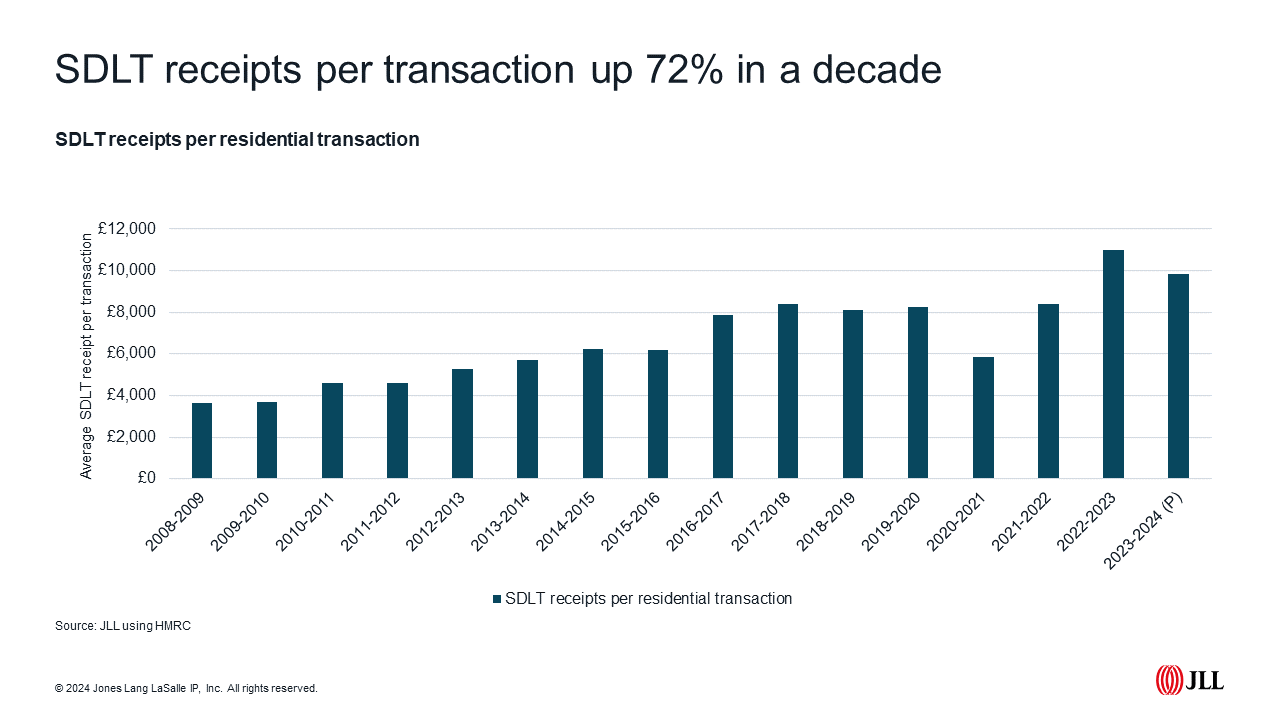

Total residential receipts in year to March 2023 (2024 data is still only provisional) were £11.7 billion. Comparing total residential receipts with the number of transactions shows a rise in revenue per transaction of 72% over the past decade, outpacing price growth by around 20 percentage points.

Of the £11.7 billion total, £4.5 billion came from London sales. London buyers account for 59% of receipts, despite London sales being just 11% of the total nationally.

The two most expensive London boroughs contributed £1.45 billion to HMRC coffers, with £690 million from sales in Kensington & Chelsea and £765 million from Westminster, 12.4% of national totals. Indeed, the top ten local authorities in terms of receipts contributed 26% of the total SDLT take. Eight of the top ten were London boroughs, with the remaining two high value Buckinghamshire and Elmbridge.

Home movers

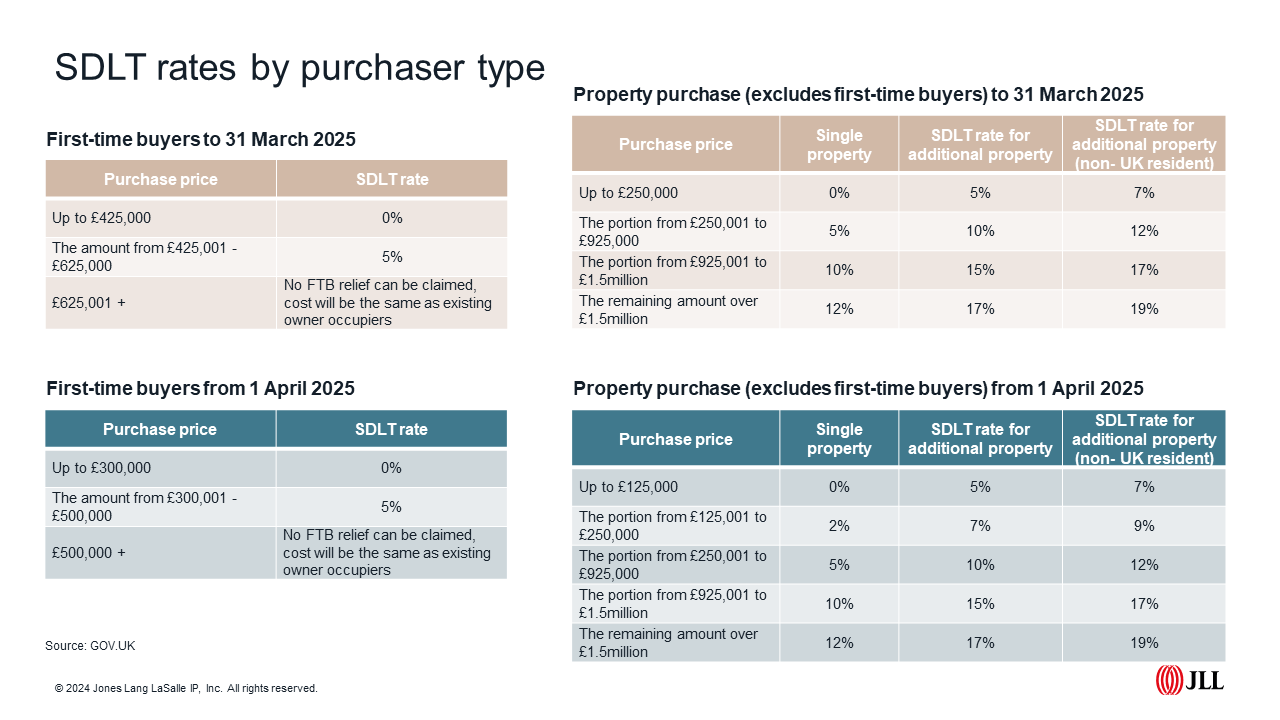

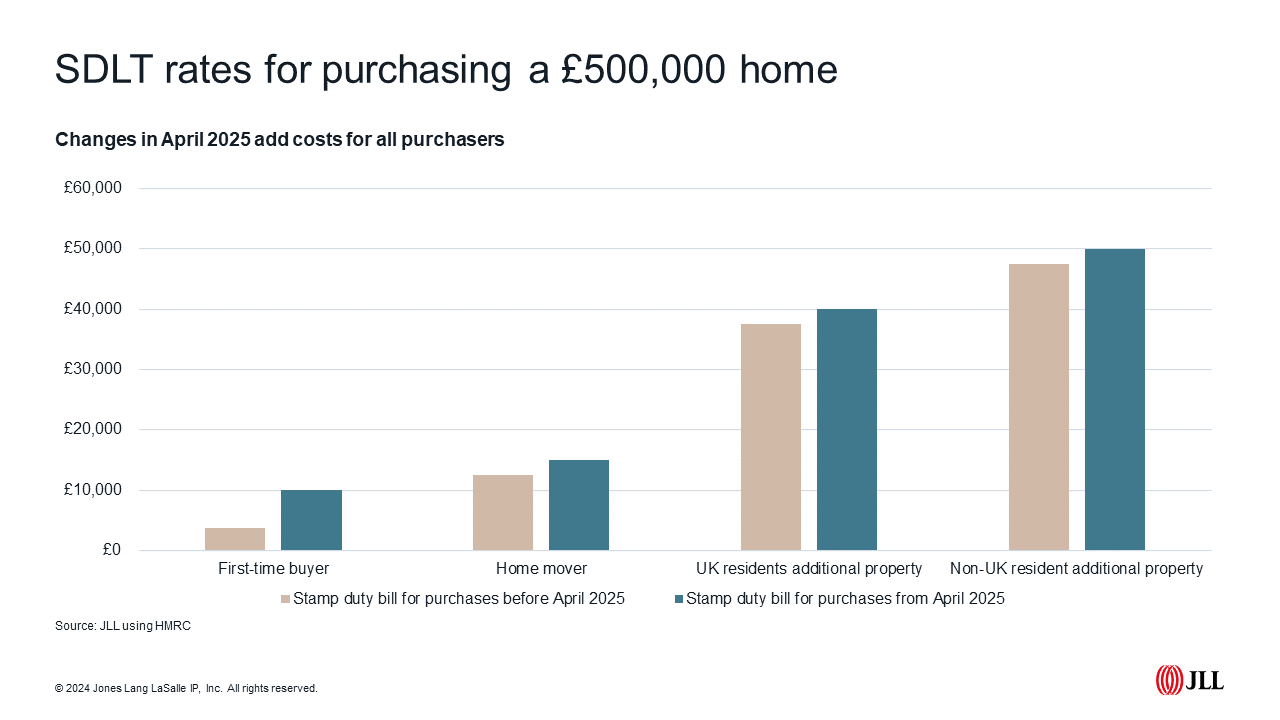

Stamp duty rates are most straightforward to understand for home movers purchasing their sole residence. Purchasers pay SDLT at differing rates dependent upon the proportion of the sale price which falls within each bracket. From April 2025 the rate at which buyers start paying SDLT returns to £125k, down from £250k currently (known as the nil-rate threshold). This will add £2,500 to the stamp duty bill for someone buying a £500,000 home.

First-time buyers

Current rules mean first time buyers purchasing homes at up to £625k have a higher threshold before they start paying stamp duty, saving buyers at the upper price limit £11,250 compared with rates from April 2025. Currently those purchasing homes up to £625k don’t pay stamp duty on the proportion of the home priced at below £425k, in April 2025 this falls back to the previous limit of £300k.

Additional homes

Higher Rates on Additional Dwellings (HRAD) accounted for £4.2 billion of SDLT receipts in the year to September 2024, almost 50% of total receipts over the 12-month period. Following the autumn Budget those purchasing an additional property will pay a higher SDLT bill. With the previous 3% surcharge rising to 5% at midnight on Budget day. The SDLT cost to purchase a £500k home as a UK resident now £37,500, up £10k on pre-Budget levels.

ATED

Annual Tax on Enveloped Dwelling, or ATED for short, is levied on residential properties owned by non-natural person, in most case those held within a company structure. It applies predominantly to properties valued at £500,000 or more with the owner required to have the property valued every five years. An annual charge is then levied depending on the property’s value. These range from £4,400 a year for homes valued at £500k to £1million, to £287,500 for homes worth more than £20 million (figures for 2024/25 financial year). On top of the annual charge properties purchased by ‘non-natural persons’ attract a 17% SDLT rate. There are exemptions and reliefs available for certain assets so well worth taking advice.

Buying multiple properties

Multiple Dwellings Relief (MDR) was abolished under the previous government. Aimed at transactions where there was more than one dwelling, essentially the purchaser paid SDLT on each property at an individual rate per property, rather than on the total purchase price. But without MDR most buyers purchasing six or more residential properties now buy through non-residential SDLT. This approach treats the purchase as a single asset, with buyers paying 0% on purchases up to £150k, 2% on purchases between £150k and £20k and 5% on purchases over £250k.

For more information on stamp duty rates click here.