Budget black holes

Those scrambling to get to the bottom of their to-do list before the summer break will recognise the urgency we've seen in recent days from government as it pushed forward on policy commitments before the summer recess.

We now have a date for the autumn budget, due to take place on 30 October, where the chancellor will attempt to deal with the £21.9bn budget ‘black hole’. Spending cuts worth £5.5bn have been announced, means testing will mean wealthier (or the least poor) pensioners losing their winter fuel allowance, and several infrastructure projects introduced under the Conservatives have bitten the dust or been firmly pushed into the long grass. Reeves has also committed to selling surplus public sector buildings and land. That leaves £16.4bn – meaning taxes are going up – although we'll need to wait until 30 October to find out which.

Building more homes

Angela Rayner has fast-tracked the consultation to overhaul the planning process, the announcement scraping in pre-recess on 30 July. The consultation, set to run over the summer, will close on 24 September, with a new National Planning Policy Framework (NPPF) promised by the year-end.

Proposed changes to boost delivery include the reintroduction of mandatory housing targets. A brownfield first strategy will remain in place, with expectations that applications on brownfield land will be approved. We are promised clarity on how to define 'grey belt' land, with any land released from the Green Belt subject to 'golden rules', namely: 50% of homes delivered as affordable housing, an emphasis on access to green space, and a recognition of the need for local infrastructure.

To enable delivery of affordable homes at scale, the government has committed to providing more direct grant funding and certainty around rent stability. A decision on the level of grant funding and rent settlement is promised for the next spending review.

The onus will be on councils to make sure they have robust and up-to-date local plans, setting out land suitable for development. Councils will be expected to have an annually reviewed five-year land supply strategy. Quite a task, as government figures suggest just a third of councils have a Local Plan that is less than five years old.

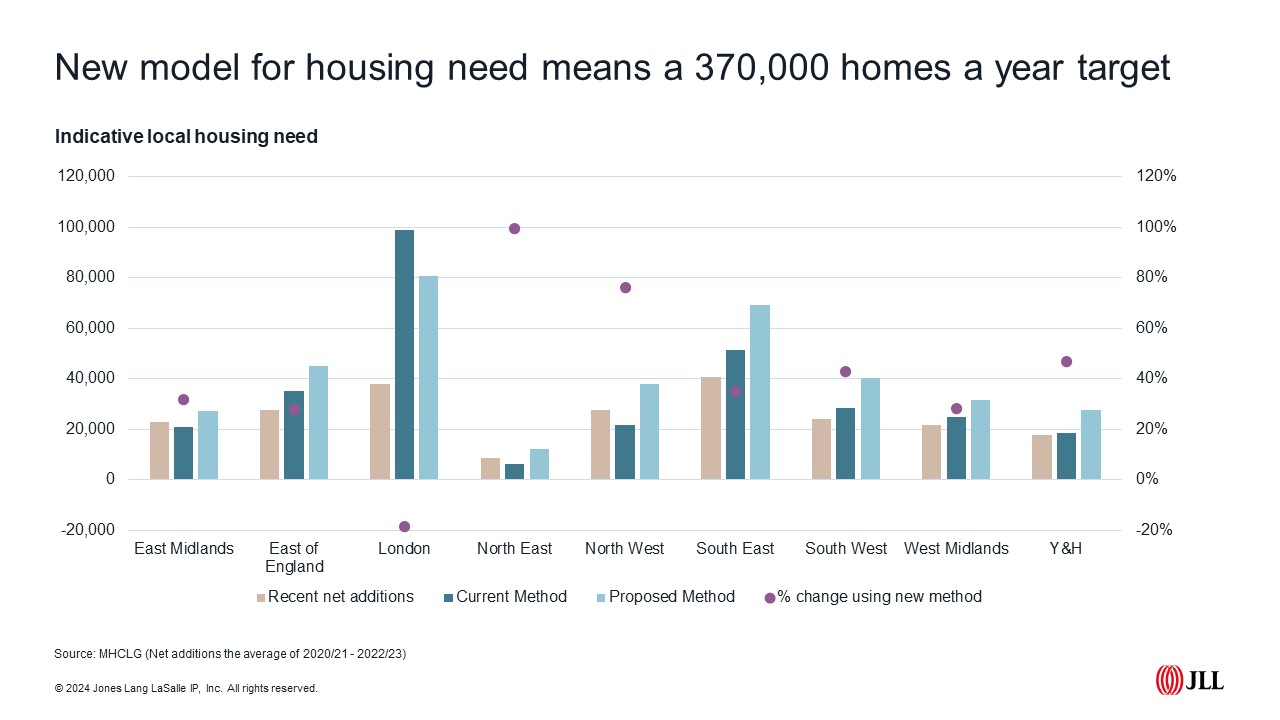

The government has also set out a new demand model, which will be used to underpin housing targets. This model calls for 370,000 homes per annum nationally, not far off double what we expect will be delivered this year.

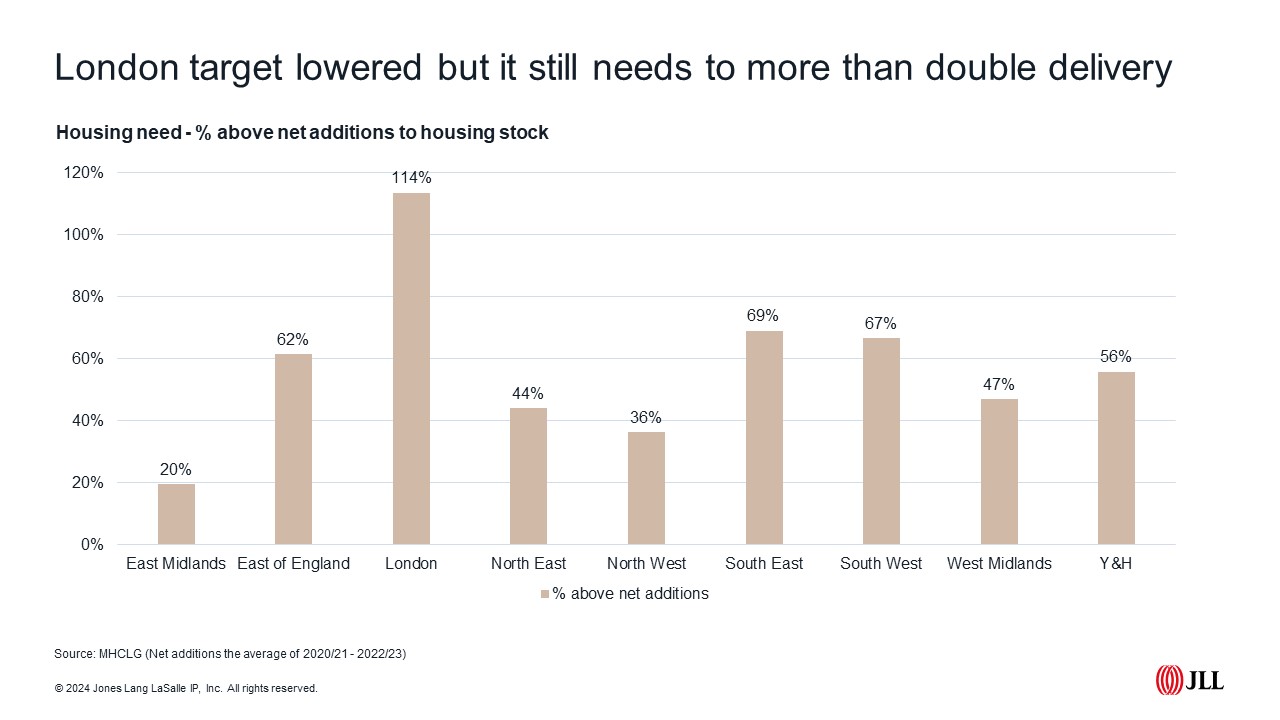

There has been some criticism that London will have a lowered target (down from circa. 100,000 to 80,000 homes) but numbers are still significantly higher than the 35,000 homes delivered in the last year and the 52,000 target in the London Plan. Comparing numbers in the new demand model still shows the capital would need to increase current delivery by 114%, the highest of any region. For more on the proposed plans click here.

In other news…

It’s been a busy week for housing news outside Westminster too, the biggest being from the Bank of England, with the bank rate dropping to 5% following the August meeting of the MPC. Even prior to the announcement Lifetime Capital saw fixed rates breach the sub-4% barrier (albeit with high entry costs). Expect to see more competitive rates emerge in the coming weeks.

Nationwide figures show house prices rose for the third consecutive month in July, with prices up 2.1% annually – the highest annual figure since December 2022. Mortgage approvals continued to hover around the 60,000 mark in June. This was down marginally on May (-0.3%) but up 12% on June 2023.

Impact on central London

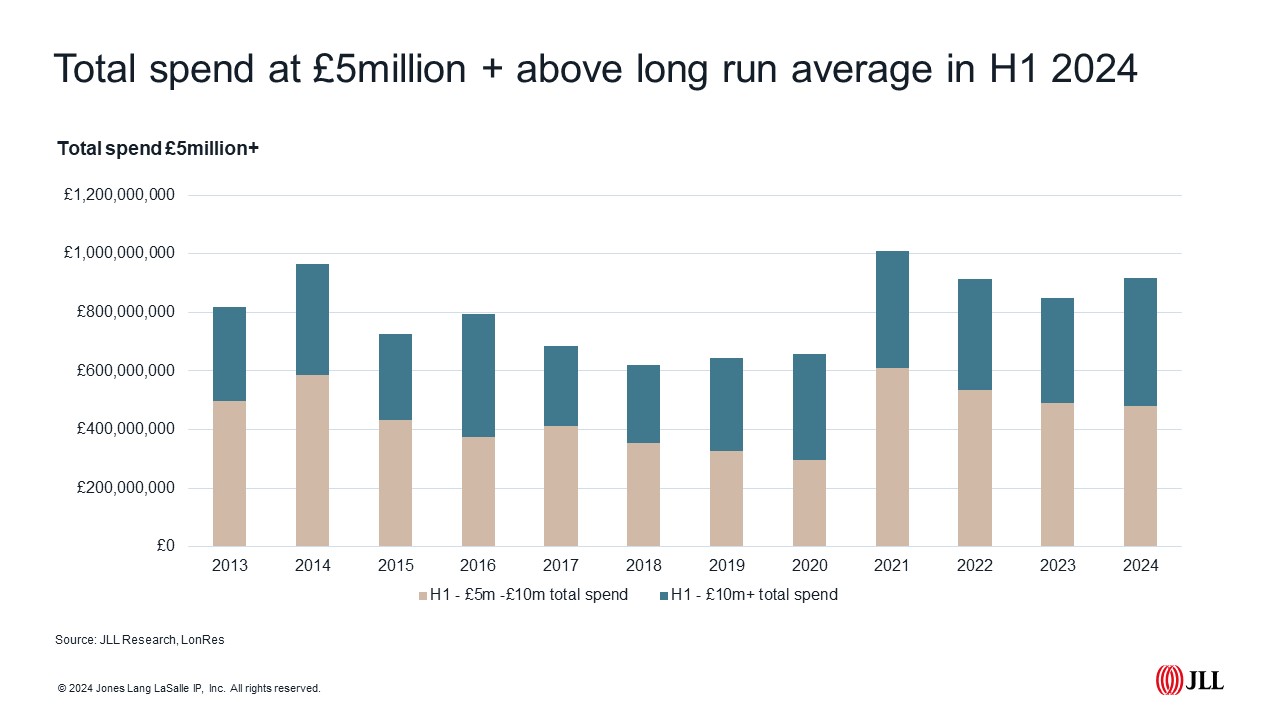

There are mixed messages from the central London market. Our Q2 Prime Central London report shows a softening in prices, with values down 5.2% in the last 12 months. But activity, particularly at the top end of the market, remains robust with the amount spent at £5 million or more up 15% in the first six months of the year compared with the 10-year average.

All this at a time when both the former Conservative and current Labour government were advocating changes to non-dom tax arrangements. Again, we’ll need to wait until the October budget for a full breakdown, but recent announcements from Rachel Reeves suggest they intend to go ahead with many of the plans set out pre-election. From April 2025 new entrants with non-domiciled tax status will receive 100% tax relief on their foreign income and gains for the first four years before reverting to the same tax arrangements as a UK taxpayer. Currently this is 15 years rather than four, although benefits begin to erode after seven years, with increased cost to retain one’s non-domiciled status. Part of the transition to the new rules will include a Temporary Repatriation Facility (TRF) allowing non-doms to bring foreign gains and income held offshore into the UK at a reduced tax rate.

For more on the government’s non-dom plans (so far) click here. And our latest PCL update can be found here.